QuickBooks Self-Employed

Apkguides Review

Features

QuickBooks Self-Employed is a feature-packed app designed specifically for self-employed individuals to manage their finances effectively. Some key features of this app include:

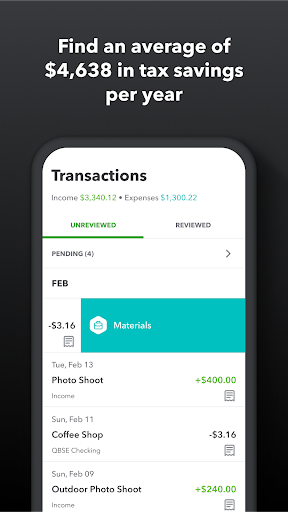

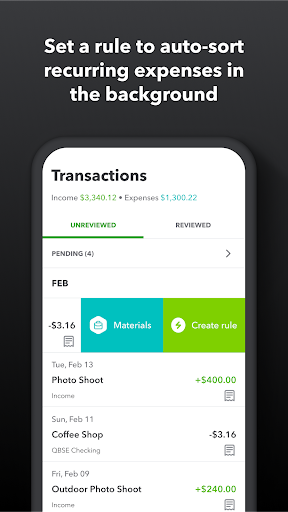

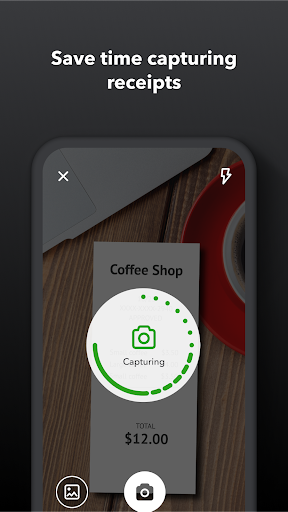

- Expense Tracking: The app simplifies expense tracking by allowing you to effortlessly categorize and record your expenses, making tax time a breeze.

- Invoicing: You can create and send professional-looking invoices to your clients directly from the app, making it convenient to receive payments.

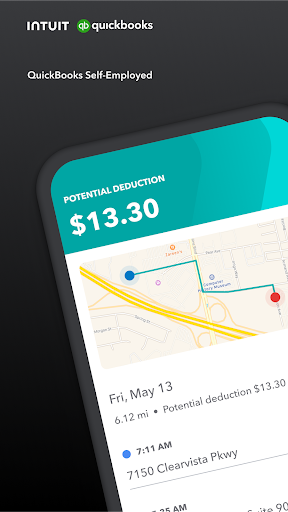

- Mileage Tracking: QuickBooks Self-Employed automatically tracks your mileage using your phone's GPS, making it easy to calculate deductions for tax purposes.

- Bank Integration: Connect your bank accounts and credit cards to the app, and it will automatically import your transactions, saving you time and minimizing errors.

Usability

QuickBooks Self-Employed has a user-friendly interface that is intuitive to navigate. The menu is well-organized, allowing for easy access to all the features. Creating and managing invoices, tracking expenses, and calculating mileage deductions are straightforward processes that can be done with just a few taps.

Design

The app features a clean and modern design that is visually appealing. The layout is well-designed, ensuring that all the necessary information is presented in a concise manner. The color scheme is pleasing to the eye, and the font choice is clear and legible.

Pros

- Simplified Expense Tracking: QuickBooks Self-Employed makes it incredibly easy to track expenses, helping you to maximize deductions and reduce tax liabilities.

- Real-time Financial Snapshot: The app provides a real-time snapshot of your financial health, giving you insights into your income, expenses, and profit.

- Invoicing on the Go: You can create and send invoices from anywhere, ensuring that you get paid faster and improving your cash flow.

- Mileage Tracking Made Easy: The app automatically tracks your mileage, eliminating the hassle of manually logging every trip.

Cons

- Limited Reporting: While the app provides basic reports on income and expenses, it lacks more in-depth reporting options that could help identify trends or analyze business performance.

- No Multi-User Access: QuickBooks Self-Employed is primarily designed for single-person businesses and does not offer multi-user access, which can be a drawback for those with a team.

In conclusion, QuickBooks Self-Employed is an excellent app for self-employed professionals who want to streamline their financial management processes. With its impressive features, user-friendly interface, and attractive design, it can significantly simplify expense tracking, invoicing, and mileage calculations. However, it's worth noting that the app's reporting capabilities are somewhat limited, and it doesn't support multi-user access.

Screenshots

Comment

Similar Apps

Top Downloads

Copy [email protected]. All Rights Reserved

Google Play™ is a Trademark of Google Inc.

Apkguides is not affiliated with Google, Android OEMs or Android application developers in any way.