Quicken: Budget, Money Tracker

Apkguides Review

Features

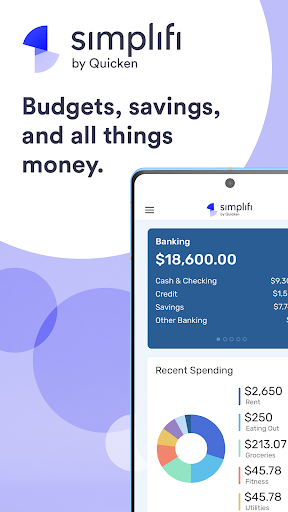

Quicken Simplifi is a powerful money management app that offers several impressive features to help users effectively track and manage their finances.

-

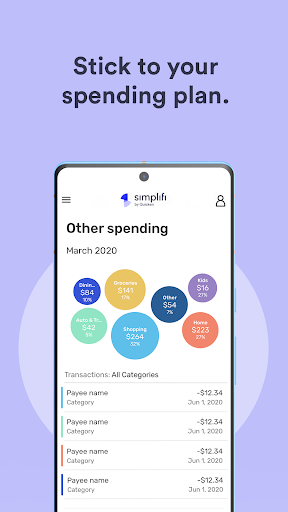

Budgeting: The app allows you to create personalized budgets based on your income and spending habits. It analyzes your expenses and provides insightful recommendations to help you stay on track.

-

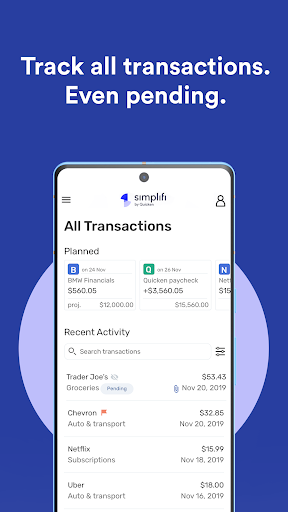

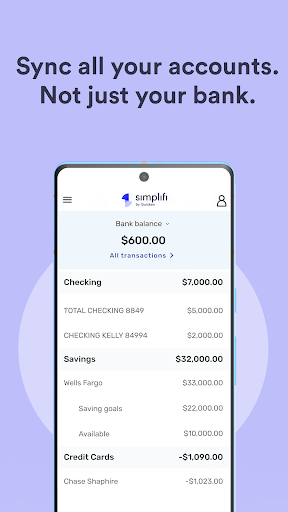

Expense Tracking: Quicken Simplifi offers an intuitive interface for effortlessly tracking and categorizing your expenses. It syncs with your bank accounts, credit cards, and various financial institutions, making it easy to automatically import and organize all transactions.

-

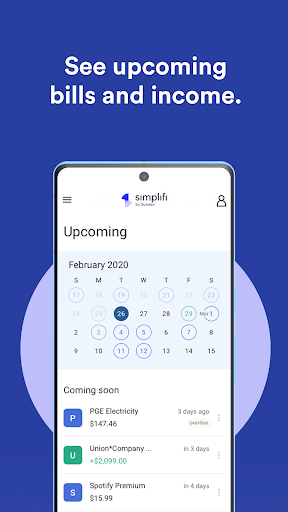

Bill Management: Simplifi sends timely alerts for upcoming bill payments, ensuring you never miss a due date. The app presents a clear overview of all your bills, helping you monitor and manage your payment schedule effectively.

-

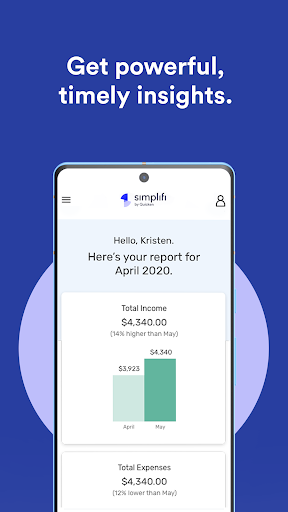

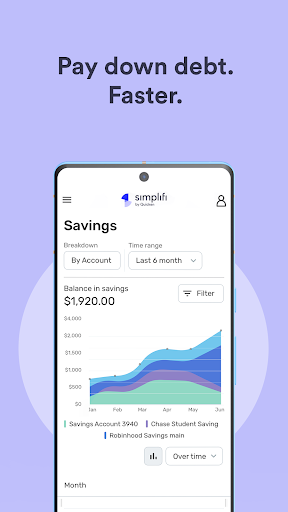

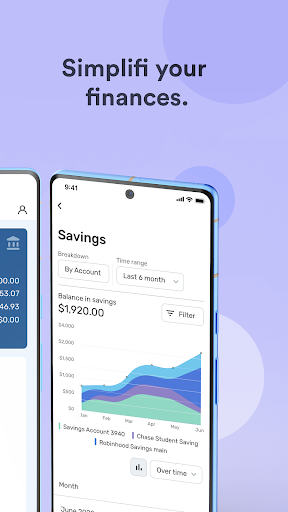

Personal Financial Dashboard: The app provides a comprehensive overview of your finances through insightful graphs, charts, and customizable reports. It allows you to easily visualize your spending patterns and identify areas where you can save money.

-

Saving Goals: Quicken Simplifi enables you to set financial goals and track your progress. Whether it's saving for a vacation or a down payment, the app keeps you motivated by displaying how much you've saved and how close you are to achieving your goals.

Usability

Quicken Simplifi is extremely user-friendly, making it suitable for individuals with various levels of financial expertise. The app's intuitive interface allows for effortless navigation, and its well-designed layout ensures that all features and tools are easily accessible. The user-friendly aspect is particularly commendable as it reduces the learning curve and encourages users to actively engage with their financial data.

Design

The design of Quicken Simplifi deserves praise for its clean and minimalistic approach. The app employs a visually appealing color scheme that enhances readability. The well-organized layout, combined with tasteful typography and consistent iconography, contributes to an enjoyable user experience. Additionally, the use of intuitive symbols and clear labeling allows users to quickly find the desired functionality.

Pros

- Streamlined interface makes it easy to manage finances on-the-go

- Comprehensive budgeting tools provide valuable insights and recommendations

- Effortlessly syncs with various financial accounts for seamless transaction tracking

- Detailed and visually appealing financial dashboard for clear overview of your monetary health

- Effective bill management features help avoid late payment penalties

Cons

- Lack of investment tracking capabilities

- Missing support for international accounts and currencies

- Some users may find the subscription-based pricing model less attractive compared to one-time payment options offered by competitors

Overall, Quicken Simplifi is a highly efficient money management app that offers a user-friendly experience, robust budgeting tools, and effective expense tracking functionalities. While it may not offer all features that some users may require, its simplicity and usability make it an excellent choice for those looking to take control of their finances effortlessly.

Screenshots

Comment

Similar Apps

Top Downloads

Copy [email protected]. All Rights Reserved

Google Play™ is a Trademark of Google Inc.

Apkguides is not affiliated with Google, Android OEMs or Android application developers in any way.